Tata Steel’s 1QFY23 Financial Results

Tata Steel reports consolidated EBITDA at Rs 15,047 crores; Net debt to EBITDA < 1.0x

|

Highlights:

|

Financial Highlights:

|

|

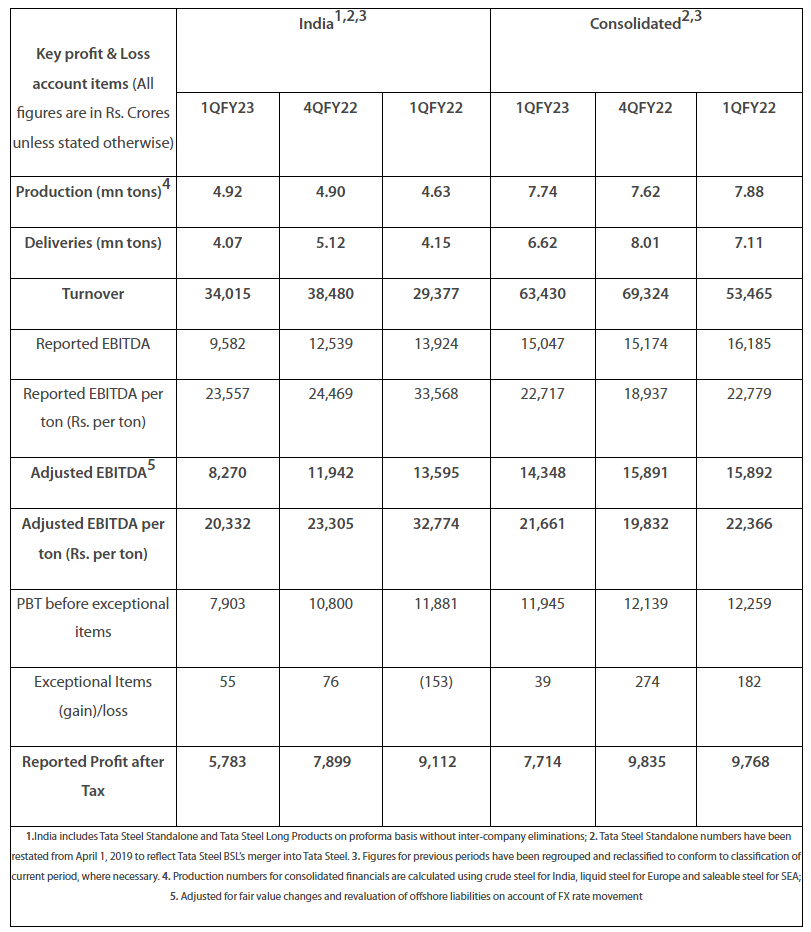

India1,2,3 |

Consolidated2,3 |

||||||

|

1QFY23 |

4QFY22 |

1QFY22 |

1QFY23 |

4QFY22 |

1QFY22 |

|||

|

Production (mn tons)4 |

4.92 |

4.90 |

4.63 |

7.74 |

7.62 |

7.88 |

||

|

Deliveries (mn tons) |

4.07 |

5.12 |

4.15 |

6.62 |

8.01 |

7.11 |

||

|

Turnover |

34,015 |

38,480 |

29,377 |

63,430 |

69,324 |

53,465 | ||

|

Reported EBITDA |

9,582 |

12,539 |

13,924 |

15,047 |

15,174 |

16,185 |

||

|

Reported EBITDA per ton (Rs. per ton) |

23,557 |

24,469 |

33,568 |

22,717 |

18,937 |

22,779 |

||

|

Adjusted EBITDA5 |

8,270 |

11,942 |

13,595 |

14,348 |

15,891 |

15,892 |

||

|

Adjusted EBITDA per ton (Rs. per ton) |

20,332 |

23,305 |

32,774 |

21,661 |

19,832 |

22,366 |

||

|

PBT before exceptional items |

7,903 |

10,800 |

11,881 |

11,945 |

12,139 |

12,259 |

||

|

Exceptional Items (gain)/loss |

55 |

76 |

(153) |

39 |

274 |

182 |

||

|

Reported Profit after Tax |

5,783 |

7,899 |

9,112 |

7,714 |

9,835 |

9,768 |

||

|

1.India includes Tata Steel Standalone and Tata Steel Long Products on proforma basis without inter-company eliminations; 2. Tata Steel Standalone numbers have been restated from April 1, 2019 to reflect Tata Steel BSL’s merger into Tata Steel. 3. Figures for previous periods have been regrouped and reclassified to conform to classification of current period, where necessary. 4. Production numbers for consolidated financials are calculated using crude steel for India, liquid steel for Europe and saleable steel for SEA; 5. Adjusted for fair value changes and revaluation of offshore liabilities on account of FX rate movement |

||||||||

Management Comments:

Mr. T V Narendran, Chief Executive Officer & Managing Director:

“This has been a challenging quarter for the Global and Indian economy with rising interest rates, supply chain constraints and slowdown in China due to COVID. Despite these multiple headwinds, Tata Steel has delivered a strong performance with an improvement in margins. Our strong marketing franchise and superior business model in India enabled us to successfully pivot and increase our domestic deliveries to counter the 15% duty imposed on steel exports in the middle of the quarter. We continue to drive value accretive growth in India backed by investments in customer relationships, brands and distribution networks and remain well positioned to benefit from the buoyant automotive & retail housing demand and the government spend on infrastructure. Our European business delivered a sharp improvement in performance as long term contracts and product mix helped drive a strong increase in realizations. We are geared towards commissioning the 6 MTPA pellet plant at Kalinganagar in 3QFY23 which will drive cost savings followed by the CRM complex and the 5 MTPA expansion project. Our subsidiary, Tata Steel Long Products, has completed the strategic acquisition of Neelachal Ispat Nigam Limited and will drive growth of our long products business. We continue to progress on our sustainability journey and are committed to being net zero by 2045. We are also focused on making Tata Steel more diverse & inclusive and were ranked 3rd among manufacturing companies by Great Place to Work in India.”

Mr. Koushik Chatterjee, Executive Director and Chief Financial Officer:

“Tata Steel continues to deliver operationally and financially despite the complex operating environment, sudden impact of regulatory changes and the heightened volatility in commodity prices. Our Consolidated revenues for the quarter stood at Rs 63,430 crores and our consolidated EBITDA stood at Rs 15,047 crores, despite the sharp rise in input costs especially coking coal and gas prices in Europe. Our EBITDA margin increased QoQ from 22% to 24% and EBITDA per ton increased from Rs 18,937 to Rs 22,717. Consolidated PAT for the quarter stood at Rs 7,714 crores. In India, Standalone revenue stood at Rs 32,021 crores and EBITDA was Rs 9,616 crores. In Europe, we achieved highest ever quarterly EBITDA of £621 million, which translates to an EBITDA per ton of £290. We expect that volatility in terms of steel price and input cost movement to continue in the next quarter but expect the spreads to stabilise in the second half of the year. We spent Rs 2,725 crores on capital expenditure in line with our annual capex guidance as we progress on our Kalinganagar expansion. The volatility in commodity prices and immediate impact of the export duty in India have led to an increase in working capital but our cost improvement and other initiatives along with expected pickup in demand in the second half of the year should result in normalisation of working capital. In spite of significant working capital pressures, the Net debt stood at Rs 54,504 crores and our financial metrics continue to remain strong with Net debt to EBITDA <1.0x. We remain committed to our annual deleveraging target of $1 billion in line with our capital allocation strategy to reduce our debt. I am happy to report that the 10:1 stock split has received the necessary approvals and the Company has set 29th July, 2022 as the record date to give effect to the split.”

About Tata Steel

Tata Steel group is among the top global steel companies with an annual crude steel capacity of 34 million tonnes per annum. It is one of the world's most geographically diversified steel producers, with operations and commercial presence across the world. The group recorded a consolidated turnover of US $ 32.83 billion in the financial year ending March 31, 2022.

A Great Place to Work-CertifiedTM organisation, Tata Steel Limited, together with its subsidiaries, associates, and joint ventures, is spread across five continents with an employee base of over 65,000. Tata Steel has been a part of the DJSI Emerging Markets Index since 2012 and has been consistently ranked amongst top 10 steel companies in the DJSI Corporate Sustainability Assessment since 2016. Besides being a member of ResponsibleSteelTM, worldsteel’s Climate Action Programme and World Economic Forum’s Global Parity Alliance, Tata Steel has won several awards and recognitions including the World Economic Forum’s Global Lighthouse recognition for its Jamshedpur, Kalinganagar and IJmuiden Plants, and Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17. The Company, ranked as India’s most valuable Metals & Mining brand by Brand Finance, featured amongst CII Top 25 innovative Indian Companies in 2021 and top 10 sustainable organisations of India Hurun Research Institute in the 2021 Capri Global Capital Hurun India Impact 50, received Steel Sustainability Champion recognition from worldsteel for five years in a row, ‘Most Ethical Company’ award 2021 from Ethisphere Institute, RIMS India ERM Award of Distinction 2021, Masters of Risk - Metals & Mining Sector recognition at The India Risk Management Awards for the sixth consecutive year, and Award for Excellence in Financial Reporting FY20 from ICAI, among several others.

To know more, visit www.tatasteel.com and WeAlsoMakeTomorrow

Disclaimer:

Statements in this press release describing the Company’s performance may be “forward looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/ supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/ or other incidental factors.

For media enquiries contact:

Sarvesh Kumar

Chief, Corporate Communications - Tata Steel

E-mail: sarvesh.kumar@tatasteel.com