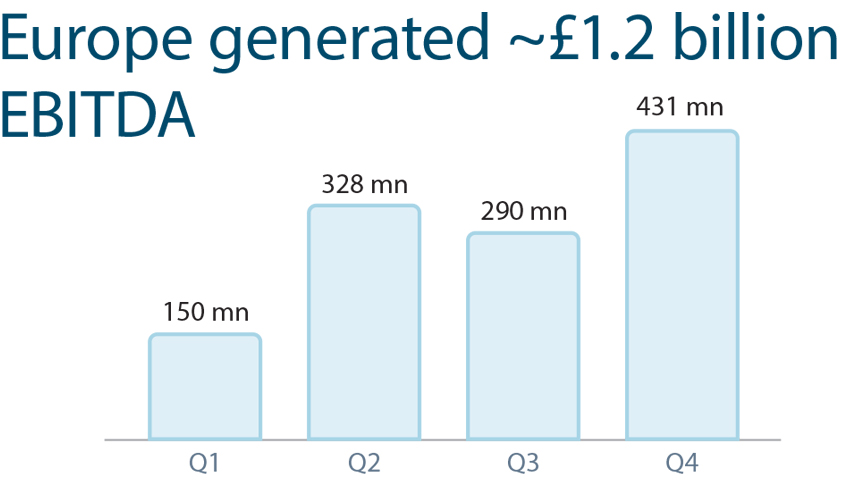

We delivered superior performance despite heightened complexities in the face of COVID-19 as well as ongoing geopolitical tensions. Our India business showed broad‑based growth across chosen segments due to sustained focus on customer relationships, distribution network and portfolio of brands supported by an agile business model. Our Europe operations delivered robust performance on the back of a strong business environment and the transformation programme undertaken by the Company.

| Tata Steel (Standalone) |

Tata Steel (India Operations) |

Tata Steel (Consolidated) |

|---|---|---|

| Crude steel production (MnT) | ||

18.38 |

19.06 |

31.03 |

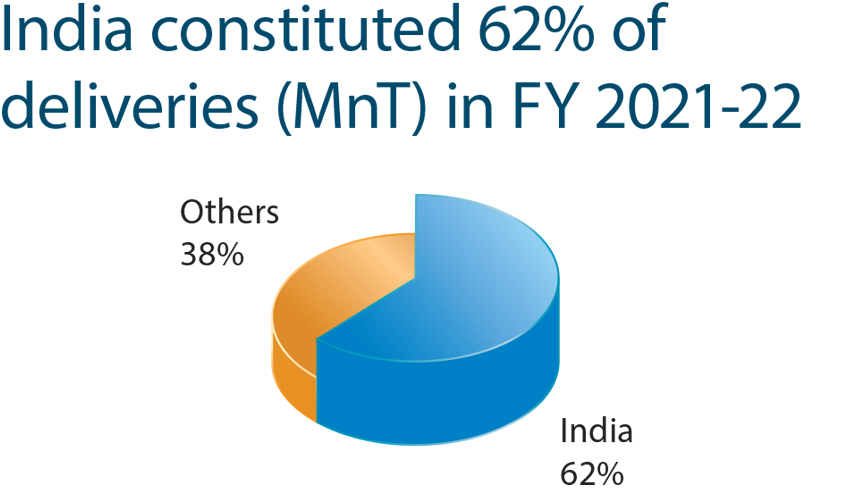

| Deliveries (MnT) | ||

17.62 |

18.27 |

29.52 |

| Turnover (` crore) | ||

1,29,021 |

1,35,823 |

2,43,959 |

| Reported EBITDA (` crore) | ||

51,456 |

52,745 |

63,830 |

| Reported EBITDA per tonne (`) | ||

29,199 |

28,863 |

21,626 |

| Reported profit after tax (` crore) | ||

33,011 |

33,641 |

41,749 |

| Cash generated from operations – before tax (` crore) | ||

53,226 |

55,113 |

56,283 |

Financial Statements of FY 2021-22 with the comparable period for Tata Steel (Standalone) and Tata Steel (India Operations) have been re-stated on account of amalgamation of Tata Steel BSL Limited and Bamnipal Steel Limited into and with Tata Steel Limited.

Tata Steel (Standalone) - Tata Steel Limited

Tata Steel (India Operations) – Tata Steel (Standalone) + Tata Steel Long Products Limited (TSLP)

Tata Steel (Consolidated) – Tata Steel (India Operations) + Tata Steel (Europe Operations) + Tata Steel (South-East Asia Operations) + Rest of the World

Numbers pertain to FY 2021-22. The percentage increase/decrease is compared to FY 2020-21

Production numbers for consolidated financials are calculated using crude steel for India, liquid steel for Europe and saleable steel for South-East Asia