Report Menu

Report Menu

Financial capital

Investing in tomorrow with efficiency, strategy and prudence

At Tata Steel, we endeavor to optimise returns for providers of financial capital. We seek to maximise surplus funds from both business operations as well as relevant monetisation of assets and investments.

We are seeking to invest our surplus in attractive growth opportunities in our core market. We also continue to opportunistically raise finance based on prevailing market conditions at the best possible cost and on suitable flexible terms given the cyclical nature of the steel industry.

Our long-term investments are focussed on strategic growth opportunities, in order to maximise returns for providers of financial capital.

STRATEGIC FOCUS

- SO1

- SO2

- SO3

To enable growth without increasing leverage and enhancing internal cash generation through efficiency and productivity

Focus on divestments, build synergies from acquisitions, and allocate capital efficiently

WAY FORWARD

- Deleveraging through internal cash flows and portfolio restructuring

- Aligning debt maturity profile to the long gestational nature of steel projects

- Divesting of non-synergistic assets

- Allocating capital on efficient and value-accretive opportunities

GOALS

Consolidate leadership position in India with organic and inorganic expansions

Sustain value creation across the cycle and build resilience against down cycles

Maintain global cost leadership

IMPACT ON SDGs

Managing financial capital

During the year, we focussed our financial capital towards strengthening our Indian operations and establishing our leadership position in the Indian market, through the acquisition of Bhushan Steel Limited (later renamed Tata Steel BSL Limited). We have also invested our financial capital towards expansion of the Kalinganagar Plant from 3 MnTPA to 8 MnTPA.

Tata Steel BSL Limited has been a ‘value-accretive’ acquisition that will give us additional capacity to retain our market share in a growing market, higher downstream integration, value addition with a complementary product mix, closer access to key markets in the northern and western regions of the country, and the option to scale up capacity through brownfield expansions.

We have also commissioned the expansion of the Kalinganagar plant to 8 MnTPA, to build state-of-the-art facilities, to strengthen our position in the high-end value-added segments such as automotive, infrastructure, lifting and excavation, etc.

Tata Steel BSL Steel Plant

SO1 - Industry leadership in steel

SO2 - Consolidate position as a global cost leader

SO3 - Insulate revenues from steel cyclicality

Key initiatives

As per our strategic priorities, we are focussed on deleveraging and enhancing cash flows.

- During the second half of Financial Year 2018-19, post acquisition of Tata Steel BSL Limited, we took steps to deleverage the balance sheet at the Tata Steel group level to the tune of `17,864 crore.

- Despite some stress in the domestic debt markets, we extended our debt maturity profile by successfully raising `4,315 crore through non-convertible debentures with a maturity of 15 years.

- The Board has recommended dividend at `13 per Fully Paid Share and `3.25 per Partly Paid Share, which is higher as compared to previous years.

Reinforcing shareholders’ trust

Moody’s Investors Service has upgraded our Corporate Family Rating (CFR) to Ba2 from Ba3. The Company’s CFR is supported by its significant, diversified and growing operating base as well as its globally cost-competitive steel operations in India.

Operational achievements

During the year under review, the Company achieved strong operational performance due to supportive realisation, cost reduction initiatives, and increase in deliveries owing to faster ramp-up of the Kalinganagar plant.

IMPROVED TURNOVER

The turnover during the current period was `70,611 crore, 16.7% higher than the previous year.

INCREASED NET CASH

The net cash from operating activities was `15,193 crore during Financial Year 2018-19 as compared to `11,791 crore in the previous year.

STRATEGIC CAPITAL ALLOCATION

The Company spent `3,677 crore towards capital expenditure (70% towards Phase II expansion of Kalinganagar).

MOVEMENT IN EBITDA

The EBITDA of the Company is at `20,744 crore, improved by 31% mainly on account of improved steel margins, attributable to higher volumes and higher realisations.

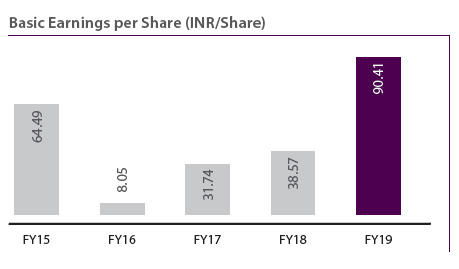

IMPROVED EPS

The basic earnings per share was at `90.41 for Financial Year 2018-19.

Kalinganagar Steel Plant

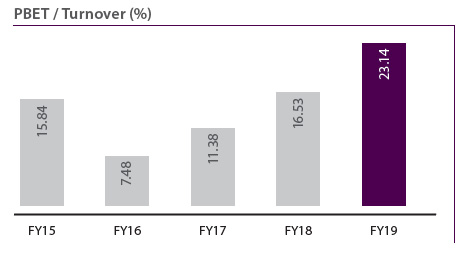

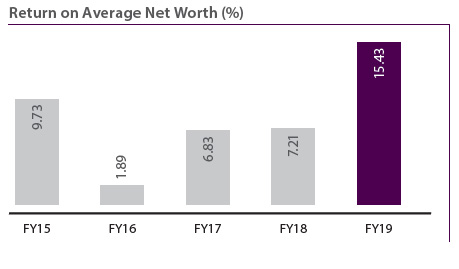

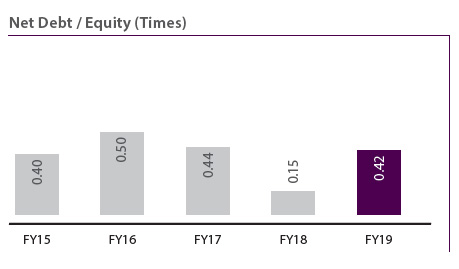

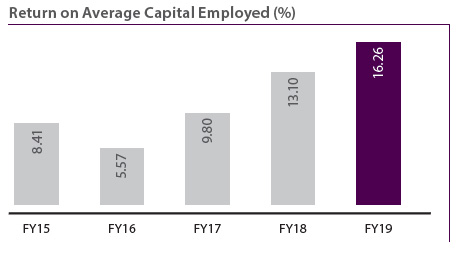

KEY PERFORMANCE INDICATORS (Standalone)

Note : FY16 to FY19 as per IND AS and FY15 as per I GAAP